Description

The Private Equity and Venture Capital course is designed to provide a comprehensive understanding of the dynamic world of private company investment. It will guide you through the principles, strategies, and practices that drive these two crucial forms of financing. Whether you are a budding entrepreneur, an aspiring venture capitalist, or a seasoned investor looking to deepen your knowledge, this course will equip you with the essential tools and insights to navigate and succeed in the private equity and venture capital landscapes.

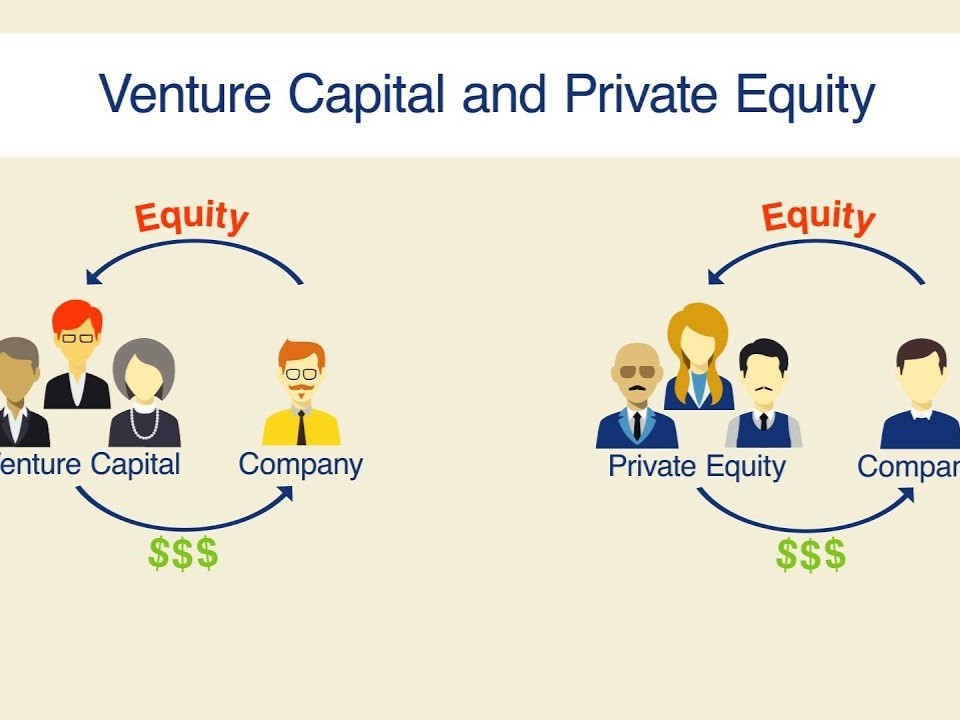

Private equity involves investing in private companies to improve their performance and eventually sell them at a profit. Venture capital, a subset of private equity, focuses specifically on early-stage, high-potential startups. Both investment forms are vital for fostering innovation, driving economic growth, and generating significant financial returns. Through this course, you will understand how private equity and venture capital firms operate, how they assess and manage investments, and their impact on the businesses they support.

Jamila –

This course provided a comprehensive overview of private equity and venture capital, covering everything from deal structuring to exit strategies. The instructors were highly knowledgeable and provided real-world examples that enhanced my understanding. I feel more confident in evaluating investment opportunities after completing this course.

Veronica –

The content was incredibly relevant to my career aspirations, and the case studies provided valuable insights into the decision-making processes of investors. The instructors did an excellent job of explaining complex concepts in a clear and concise manner.

Kabir –

Having worked in the finance industry for several years, I was pleasantly surprised by the depth of insight offered in this course. The guest lectures from industry experts provided invaluable perspectives on deal execution and negotiation strategies.